Smart Giving Made Simple: Maximize Your 2025 Impact and Benefits

December 8, 2025

This time of year invites reflection—on what we’ve accomplished together in our 25 years of Amazon Conservation and on the impact we hope to make next. Protecting the Amazon is a collective effort, made possible by people committed conservationists like you who choose to give in ways that reflect what they value. Whether you’re exploring tax-smart options to make your annual gift or simply want to deepen your support for the Amazon with an extra gift, here are several giving pathways that can help.

Do You Know All the Ways You Can Give?

- Become a Wild Keeper as a Monthly Donor: Our Wild Keeper Monthly Giving Program provides steady, reliable support that allows us to strengthen long-term conservation programs across the Amazon. When making your online gift, simply select the “Monthly” option to join.

- Smart Giving with DAF or QCD Contributions: If you have resources already set aside in a Donor-Advised Fund (DAF) or retirement account, consider making a charitable contribution this year to take advantage of current tax benefits. Learn more here.

- Smart Giving with Non-Cash Assets: Donating non-cash assets–including stocks, securities, and cryptocurrency–often comes with greater tax benefits for you, thereby both increasing the overall value of your contribution and making a sizable impact on our mission. Learn more here.

- Smart Giving with Planned Gifts: Include Amazon Conservation in your will, trust, or estate plan to create a lasting legacy. Find out how to make your planned gift for free.

- Matching Gifts & Other Options: Many employers offer a match for gifts made by employees, sometimes even including retirees and spouses. Explore matching options and other ways to give here.

Important Year-End Tax Updates

As a result of the One Big Beautiful Bill Act, tax laws will change starting January 1, 2026. Making your gift now can help you secure the most favorable benefits while supporting urgent conservation efforts. Here are a few notable upcoming changes from the One Big Beautiful Bill Act:

For donors who itemize (vs. taking the standard deduction):

For donors who itemize (vs. taking the standard deduction):

- A new nondeductible threshold: The first portion of charitable giving will no longer be deductible for some donors, reducing the after-tax value of gifts.

Many donors are choosing to ‘bunch’ multiple years of giving into 2025—often through a Donor-Advised Fund—to maximize deductions. - A new cap on total deductible giving: This shift could significantly reduce tax benefits for some donors.

Make any cash or stock gifts—and contributions to your DAF—by December 31 to take full advantage of 2025’s more favorable rules.

For Donors Aged 65+: Those aged 65 and older may now claim an additional charitable deduction of up to $6,000 per individual, on top of the existing senior deduction. This temporary benefit makes 2025 an especially advantageous year to give.

Make the Most of Your 2025 Giving

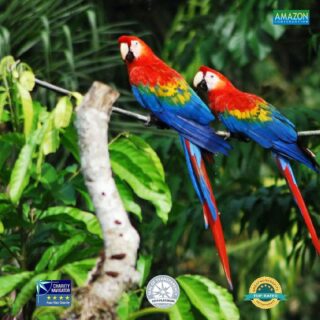

This year offers unique opportunities to make a powerful impact while maximizing current tax benefits. Whether you give monthly, donate stock, contribute through a DAF, or plan a legacy gift, your generosity strengthens our priorities to protect the core of the Amazon, halt illegal deforestation, and strengthen forest-based economies and community-driven conservation that keep the Amazon standing.

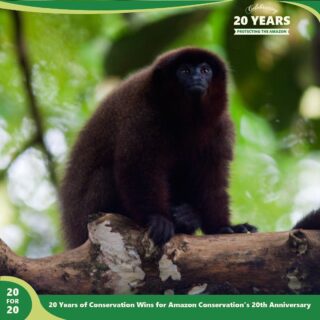

Your gift today can protect wildlife and forests and build a thriving future generations.

Loading...

Loading...